Best accounting software in Australia for small businesses in 2024

This is branded content.

Accounting software is an essential tool for any business, regardless of its size. Knowing which is the best accounting software for your small business will differ from that of medium-sized enterprises, and large organisations will have unique requirements.

This article will provide an overview of the accounting software landscape in Australia and highlight the top picks for each business size. Whether you are a small business owner or a CFO of a large corporation, this article will help you choose the right accounting software for your business.

Top 5 picks for accounting software in Australia

- MYOB - Overall best accounting software (buy 1 month, get 3 months free)

- FreshBooks - Cloud-based accounting solution for small business

- QuickBooks - Popular small business accounting software

- ZOHO Books - Best accounting software for features

- Microsoft Dynamics 365 - Good accounting platform for medium businesses

Overview of the best Australian accounting software

When it comes to small businesses, accounting software needs to be user-friendly, scalable, and affordable. The following accounting software options are the top picks for small businesses in Australia, from basic bookkeeping to advanced financial management.

MYOB is a popular accounting and business management software in Australia, with solutions for businesses of all sizes. We found it has a good range of features, including invoicing, expense tracking, inventory management, payroll, and tax compliance. MYOB is scalable, which means that it grows as your business also grows. It is available in both online and desktop versions, making it a flexible option for your business that you can access at any time and place with internet connectivity.

When it comes to pricing, MYOB is quite affordable starting at $30/month for MYOB Business Lite, with options to add on payroll and inventory management features. It is more than adequate to start off with for small business owners. In addition, for more advanced business needs, MYOB has plans ranging from $55/month through to $170/month. Moreover, MYOB currently has a limited-time offer of buy one month, get three months free when you purchase one month subscription. Terms and conditions apply. Claim the limited-time offer now.

2. FreshBooks - Good cloud-based accounting software (Rating 4.7/5)

FreshBooks is a cloud-based accounting software option that is designed for small businesses and freelancers. It offers a range of features, including invoicing, time tracking, and expense tracking. FreshBooks is known for its user-friendly interface and exceptional user experience, which makes it stand out from the competition in this list. It has received positive reviews from various reputable sources such as Forbes, PCMag, and NerdWallet, who have praised its intuitive design, affordability, and double-entry accounting reports feature.

While it may not have as many features as MYOB, it's an affordable accounting solution that starts from $5.75/month with its current promotion. This includes unlimited tracking of income and expenses, but there are charges for additional features with the starter plan to be aware of. In short, if you are a freelancer, solopreneur, or small business owner looking for an easy-to-use accounting software that can help you streamline your finances, FreshBooks might be the solution you are looking for.

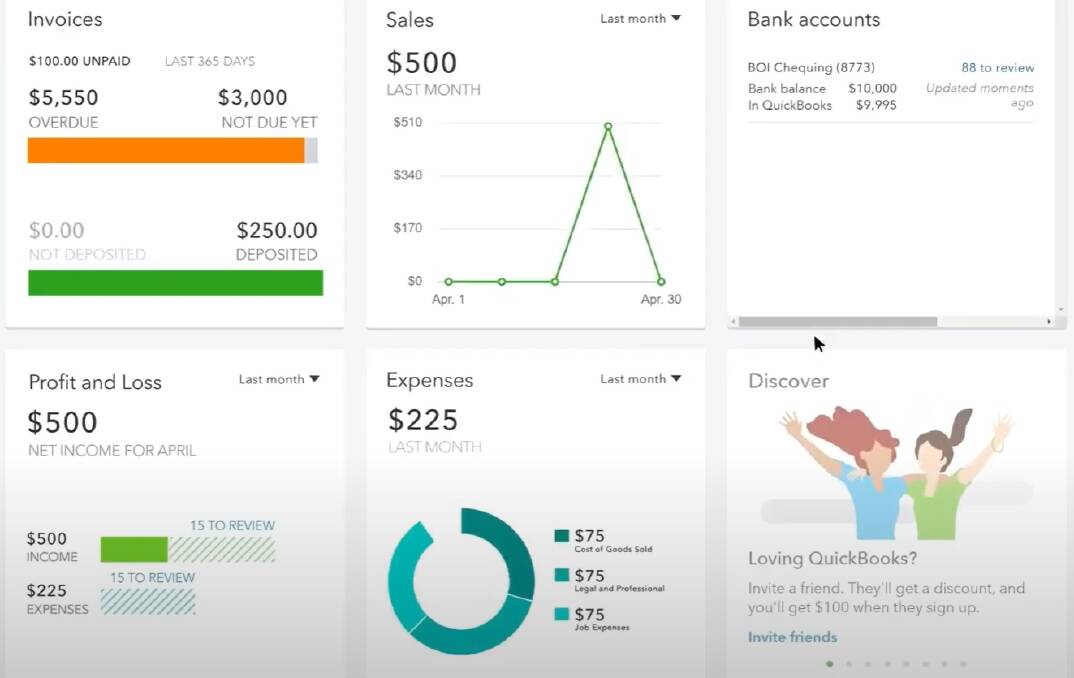

3. QuickBooks Online - Popular for small businesses in Australia (Rating 4.7/5)

QuickBooks Online is a popular accounting software option for small businesses in Australia. It offers a range of features, including invoicing, expense tracking, and payroll. QuickBooks Online is also cloud-based, which means that it can be accessed from anywhere with an internet connection. It is known for its user-friendly interface and its affordability, making it a great option for small business owners who are just starting.

QuickBooks is another popular accounting software in Australia, offering a range of solutions, including QuickBooks Online and QuickBooks Self-Employed, to cater to the needs of small businesses and self-employed individuals. Reckon is a leading provider of accounting software solutions in Australia, offering a range of solutions, including Reckon One, Reckon Accounts Hosted, and Reckon Elite, to cater to the needs of businesses of all sizes.

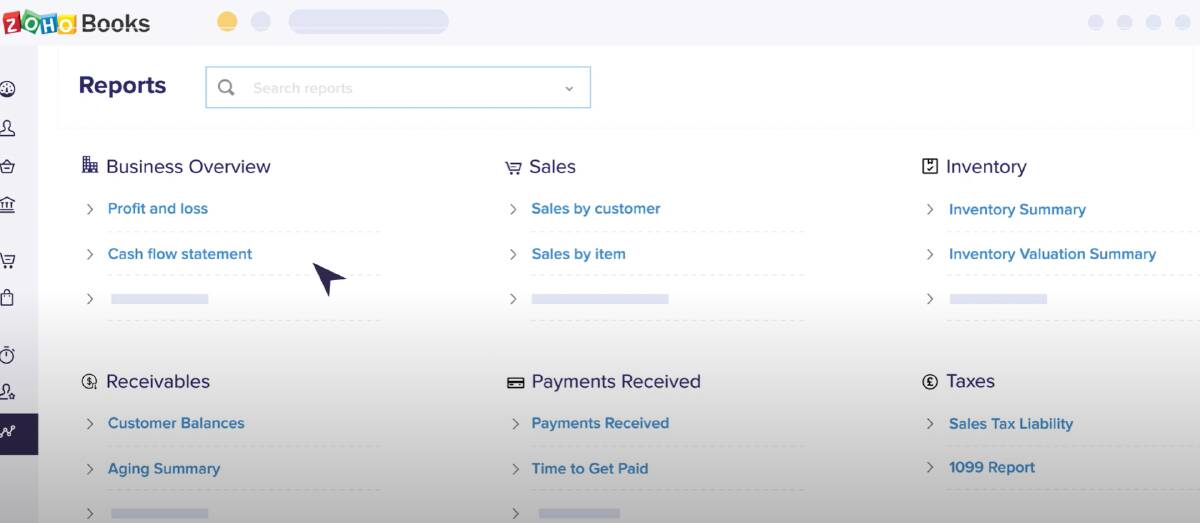

4. ZOHO Books - Account software diverse with features (Rating 4.6/5)

Zoho Books is a cloud-based accounting software designed for small and medium-sized businesses. It offers a range of features including invoicing, expense tracking, project management, and more. With Zoho Books, you can manage business finances from anywhere, at any time. Interestingly, there is a free pricing plan to track and manage income, and expenses and generate up to 10,000 invoices per annum. The base paid plan starts from $16.50 a month which is competitive compared to the others in this comparison.

According to user reviews, Zoho Books is generally well-liked for its ease of use, affordability, and comprehensive feature set as mentioned. Some users have noted that the software can be slow at times and that customer support can be slow to respond. However, overall feedback is positive, with users praising the software's flexibility and customisation options. In short, ZOHO Books is a great option to consider for both accountants and non-accountants.

5. Xero - Reputable all-in-one accounting software (Rating 4.5/5)

Xero is another popular accounting software option in Australia that is gaining a reputation for small businesses and sole traders. Like FreshBooks, it is known for its simple and easy-to-navigate software interface and its range of features. To mention a few, these include invoicing, payroll, and inventory management. This is an important aspect for business owners who are not technically savvy.

Everything you need can be found all in one place with its cloud-based platform. This means you can keep track of your business financials anywhere with an internet connection. This makes it a great option for small business owners who need to work remotely.

There are several plans available depending on the features you need, the type, and the size of your business. The cheapest software package starts from $32/month which is slightly more expensive than MYOB and should be taken into consideration by comparing all the features.

Best choices for medium-sized enterprises

When it comes to accounting software for medium-sized enterprises, there are several options available in Australia. In this section, we will discuss three of the best choices for medium-sized enterprises, including Sage Business Cloud, NetSuite ERP, and Microsoft Dynamics 365.

1. Microsoft Dynamics 365 - Customisable accounting software (Rating 4.6/5)

First on the list in the accounting software for the medium-sized business category is Microsoft Dynamics 365, one of the leading companies in the software space. It has a wide range of features, including financial management, project management, and supply chain management that you would expect. Similar to QuickBooks, the suite of cloud-based software solutions can help your business become more agile and reduce complexity without increasing costs.

One of the pros of Microsoft Dynamics 365 is its integration with other Microsoft products. This can help to streamline your business processes and improve efficiency. Additionally, Microsoft Dynamics 365 offers robust reporting capabilities, allowing you to gain insights into your financial data and make informed business decisions. Another strength is the software is highly customisable meaning you can tailor the software to suit your business requirements. And if that's not enough, there are useful AI tools for predictive analytics to better help you understand your customers.

2. Sage Business Cloud - Best accounting software for medium businesses (Rating 4.4/5)

Sage Business Cloud is a reliable and efficient solution for small businesses that need simple accounting software. With its range of features and user-friendly interface, it is an excellent choice for businesses that want to streamline their accounting processes. It allows users to manage their finances, track expenses, and generate financial reports.

The software uses double-entry accounting, which ensures that all transactions are recorded accurately. You can also create and send invoices to customers, and track payments with a breeze. The software supports multiple payment methods, including credit cards, PayPal, and bank transfers

One of the key benefits of Sage Business Cloud is its scalability. It can grow with your business, making it a great choice for small-to-medium-sized entrepreneurs who are looking to expand. Additionally, Sage Business Cloud offers a user-friendly interface that is easy to navigate, making it a great choice for businesses that are new to accounting software and want to keep it simple.

3. NetSuite ERP - Advanced software for medium businesses (Rating 4.4/5)

NetSuite ERP is another popular accounting software solution for medium-sized enterprises. It is feature-rich with various tools to help track and manage your business finances.

NetSuite ERP's financial management module provides a complete set of accounting features, including general ledger, accounts payable and receivable, bank reconciliation, fixed assets, and cash management. It also offers robust reporting and analytics capabilities, allowing users to gain real-time insights into their financial performance. Similar to Microsoft Dynamics, one of the key benefits of NetSuite ERP is its flexibility. It can be customised to meet the specific needs of your business.

Best accounting solutions for large organisations

Large organisations require accounting software that can handle complex financial transactions and high volumes of data. Here are two of the best accounting solutions for large organisations in Australia:

1. Oracle Financials Cloud - Good accounting and financial software (Rating 4.7/5)

Another accounting program appropriate for large businesses is Oracle Financials Cloud. As stated on their website, the platform connects and automates your financial management processes, including payables, receivables, fixed assets, expenses, and reporting, for a clear view of your total financial health.

Automating financial procedures is one of Oracle Financials Cloud's primary functionalities. It offers sophisticated automation features that let businesses increase accuracy and decrease the amount of manual data entering. Additionally, Oracle Financials Cloud offers real-time financial data, enabling organisations to act swiftly and decisively.

2. SAP S/4HANA - Best accounting platform for scaling (Rating 4.6/5)

If you're a larger company, the comprehensive accounting solution provided by SAP S/4HANA Cloud ERP is worth considering. It is capable of managing large amounts of data and is built to manage intricate financial operations for complex business operations. This is made a breeze by SAP S/4HANA with its prompt and informed decision-making tools such as real-time financial analytics which is essential.

The ability of SAP S/4HANA to integrate with other SAP products is one of its primary characteristics and desirable points. Organisations can decrease manual data entry (reduce accounting errors) and streamline their financial processes as a result.

Additionally, SAP S/4HANA offers sophisticated analytics and reporting features that give businesses a better understanding of their financial performance. Unlike the small to medium accounting platforms, SAP S/4HAHA users will benefit from training to competently use the software.

Why you need accounting software

In simple terms, accounting software helps businesses track income and expenses. It can take out the laborious and time-intensive task of managing business finances by automating certain aspects. Whether as a sole trader or a small business, here are several reasons you should consider implementing accounting software:

Financial reporting. Generate various financial reports quickly, including income statements, balance sheets, and cash flow statements all in one place and well-organised.

Automate invoicing and billing. The software can take care of invoicing and billing processes to help ensure timely and accurate payments. Save your time. Automation features can save you time with the automation of repetitive tasks such as data entry, invoicing, and reconciliation. In addition, real-time updates and reporting can enable faster decision-making.

Compliance. Accounting software programs can automate calculations and generate reminders to help ensure timely tax payments, compliance with ATO small business reporting requirements, and easily generate reports for tax filings.

Integration. Many accounting software programs integrate with other business applications, such as CRM and e-commerce platforms. They are also great platforms to outsource and delegate tasks with remote access, facilitating collaboration among team members and accountants.

Fewer errors and mistakes. Reduced manual data entry minimizes the risk of errors by manual entry. Automation helps maintain accurate financial records and reduces the likelihood of miscalculations.

Cheaper than an accountant. While there is an initial investment (or recurring), the long-term cost savings from increased efficiency and reduced errors can be substantial. In addition, it could save hours at the accountant's office.

How to choose the right accounting software for your business

Choosing the right accounting software for your business is a critical decision that can have a significant impact on your financial management. Here are some factors to consider when selecting the best accounting software for your business:

1. Identify your business requirements. Determining your company's needs is the first step in choosing the best accounting software. Take into account your company's size, the intricacy of your financial processes, and the total number of individuals that will require software access.

2. Know what features and tools you need. Features vary throughout accounting software packages. While some software may have more sophisticated functions like payroll administration, inventory monitoring, and project management, others may only have more basic functionalities like invoicing, cost tracking, and financial reporting. Select the program with the capabilities that are most crucial to running your small business.

3. It's easy to use. Don't make it harder than it needs to be. Ensure that the software is user-friendly and that your team can easily navigate and use it to get what you need.

4. Won't cost you a fortune. The cost of the accounting software is also an important consideration. Look for software that fits within your budget and offers the best value for money. Most accounting software providers will charge either a recurring monthly fee or an annual package (which is usually cheaper).

5. Integrates with other software. Consider the integration capabilities of the accounting software if it can enhance or support your current business. This will help to streamline your business operations and improve efficiency.

What features should you look for?

When choosing the best accounting software for your business in Australia, there are several key features to consider. Here are some of the most important ones:

Compliance with Australian Tax Law. One of the most important features to consider when choosing accounting software in Australia is compliance with Australian tax law. This means that the software should be able to handle the GST (Goods and Services Tax) and other tax requirements in Australia. It should also be able to generate reports that comply with Australian tax law, such as Business Activity Statements (BAS) and Instalment Activity Statements (IAS).

Integrations. Another important feature to consider is integration capabilities. Thesoftware should be able to integrate with other systems that you use in your business, such as your bank account, payment gateway, and inventory management system. This will help you to streamline your business processes and reduce manual data entry.

Straight-forward to use. A user-friendly interface is also important when choosing accounting software in Australia. The software should be easy to use and navigate, even for those who are not familiar with accounting terminology. It should also have a clean and modern design that is easy on the eyes.

Scalability and customisation. Scalability and customisation are also important features to consider. The software should be able to grow with your business and accommodate your changing needs. It should also be able to be customised to suit your specific business requirements, such as customised invoices and reports.

Support and training options. Finally, support and training options are important when choosing accounting software in Australia. The software company should offer comprehensive support and training options, such as phone and email support, online tutorials, and user guides. This will help you get the most out of your software and ensure you use it correctly.

How much does accounting software cost?

Accounting software in Australia is usually subscription-based which can cost from as little as $5.75 a month up to more than $150 per month. The pricing varies on the features included within each package depending on what you need for your business. How much you spend could also be impacted by the size of your business. Smaller businesses may be able to find a less expensive basic plan, while larger enterprises may need to upgrade to a more costly standard or premium plan.

To give you an idea of how much accounting software can cost, here is comparison pricing for the most popular platforms:

- MYOB: From $15 per month

- FreshBooks: From $5.75 per month

- QuickBooks: From $12.50 per month

- ZOHO Books - $16.50 per month

- XERO: From $32 per month

Frequently asked questions

What are the most cost-effective accounting solutions for Australian small businesses?

There are several accounting solutions available for Australian small businesses. Some of the most popular options include MYOB, FreshBooks, and QuickBooks. These platforms offer a range of features and pricing plans to suit different business needs and budgets.

Which free accounting platforms are suitable for sole traders in Australia?

Several free accounting platforms are available for sole traders in Australia. Some of the most popular options include Wave, ZipBooks, and GnuCash. These platforms offer basic accounting features, including invoicing and expense tracking. While they may not have all the features of paid platforms, they can be a good starting point for small businesses before upgrading to premium accounting software such as MYOB and FreshBooks.

What are the preferred accounting software options for small to medium enterprises in Australia?

Small to medium enterprises in Australia often prefer Xero, MYOB, and QuickBooks for their accounting software needs. These platforms offer a range of features, including invoicing, expense tracking, and financial reporting. Additionally, they offer integrations with other business tools, such as payment gateways and e-commerce platforms.

Are there any accounting software packages available for purchase without a subscription in Australia?

Yes, there are accounting software packages available for purchase without a subscription in Australia. Some of the most popular options include Sage Accounting and Acclipse. They also offer one-time purchase options, making them a good choice for businesses that prefer to avoid subscription-based models which are fast becoming the norm in the industry.